Fourth quarter earnings season is winding down with only about a dozen companies in the S&P 500 left to report. After a slow start mired by messy bank results early on, corporate America picked up the pace and ended up delivering results well ahead of expectations. The “Super Six” was part of the story — the Magnificent Seven minus Tesla (TSLA) — but resilient profit margins are also noteworthy. Here we review fourth quarter earnings season and share some thoughts on the earnings outlook for 2024.

Solid Results After A Slow Start

As we wrote in our January 16, 2024, Weekly Market Commentary, the bar was lowered heading into earnings reporting season, setting corporate America up for some solid upside. Specifically, fourth quarter earnings estimates for the S&P 500 were cut by 6.8% from September 30, 2023, through January 12. We also highlighted U.S. dollar weakness and healthy Korean export activity as indicators of potential upside.

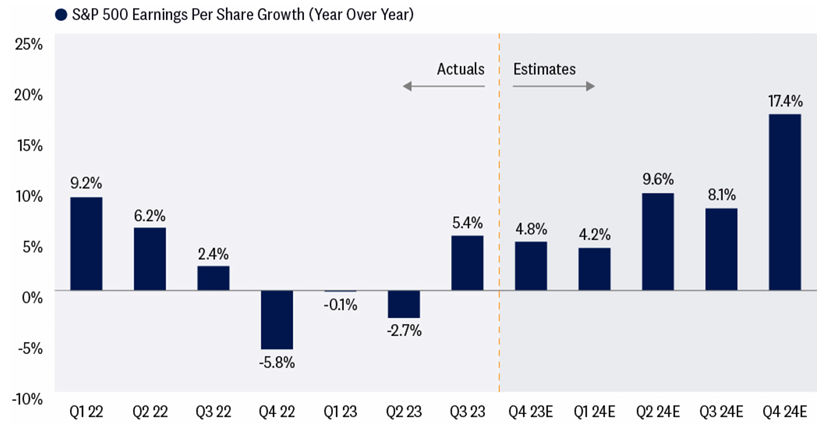

At the same time, however, mixed economic data, commodity price weakness, and challenges in the healthcare sector suggested upside might be capped. In the end, with just a handful of companies left to report, the S&P 500 delivered the 5% earnings growth and about five points of upside that we predicted. Strong results for mega cap technology and resilient profit margins helped offset the drag of special bank charges to replenish the FDIC deposit insurance fund.

S&&P 500 Delivers Solid Mid-Single-Digit Earnings Growth in Q4

Earnings Growth Poised to Accelerate As 2024 Progresses

Source: LPL Research, FactSet 02/29/24

Indexes are unmanaged and cannot be invested in directly. Estimates may not develop as predicted.

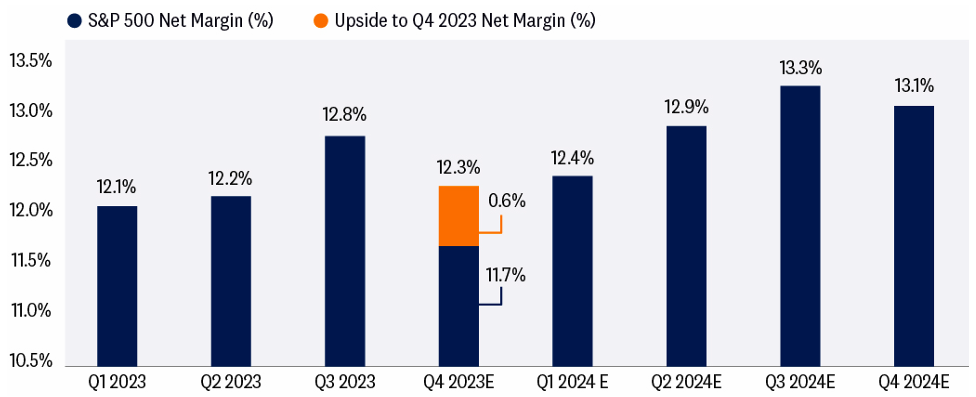

Resilient Margins A Key Component Of The Upside

Part of our premise for the upside to earnings expectations was that analysts’ consensus was factoring in too much margin compression. When December year-end reporters started posting results, the consensus net margin estimate was calling for 110 basis points of compression. Instead, it looks like we’re going to get less than half that amount.

Some of that upside in margins came from revenue upside — the S&P 500 has reported 4.2% sales growth, a full percent above initial estimates. Some of the resilience reflects companies managing expectations, i.e., setting the bar low. Some was reflected in consumer inflation outpacing producer inflation, which is generally good for profit margins. But some of it also reflects companies’ ability to control costs and maintain pricing power in a disinflationary environment.

Consumers may increasingly push back on price increases in the quarters ahead, but for now, corporate America is doing an excellent job preserving margins, while demand from consumers and businesses has been strong enough to generate respectable sales gains.

Nice Upside Surprise In Q4 Profit Margins

Source: LPL Research, Bloomberg 02/29/24

Indexes are unmanaged and cannot be invested in directly. Estimates may not materialize and are subject to change.

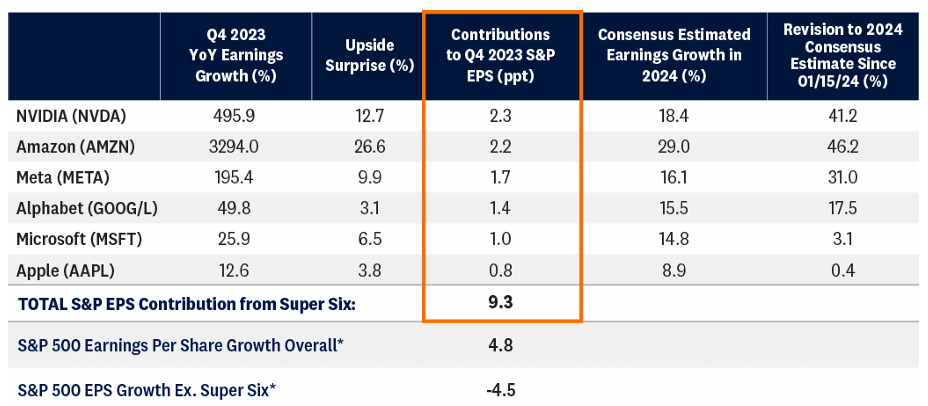

Super Six Played A Big Role

We also wrote about the mega cap technology companies (usually referred to as the Magnificent Seven) in our earnings season preview in January, pointing out that results for this group would be a key factor in determining whether S&P 500 companies could deliver attractive earnings upside. Well, that comment proved prescient because this group delivered on lofty expectations and then some.

The numbers speak for themselves. Removing Tesla, which experienced a drop in earnings in the fourth quarter, the Super Six drove more than nine percentage points of earnings contribution for the S&P 500. More specifically, S&P 500 earnings per share would have declined 4.5% in the quarter if not for these six companies. Add them in and that decline becomes a 4.8% increase.

If that wasn’t impressive enough, expectations for 2024 results for this group were lifted significantly. While Apple’s and Microsoft’s consensus EPS estimates for this year increased modestly, the top four saw increases of between 17.5% and 46.2%. And these aren’t small companies, with S&P 500 weightings of 3.7% (NVDA), 3.4% (GOOG/L), 3.3% (AMZN), and 2.2% (META). So not only did this group grow earnings significantly last quarter, but their already very strong outlooks were strengthened further by a healthy dose of management optimism.

Huge Earnings Contribution From “Super Six” In Q4

*Earnings season not fully completed with 488 S&P 500 companies having reported Q4 2023 results.

Source: LPL Research, FactSet 02/29/24

Indexes are unmanaged and cannot be invested in directly. Past performance is no guarantee of future results.

Any companies referenced are being presented as a proxy, not as a recommendation.

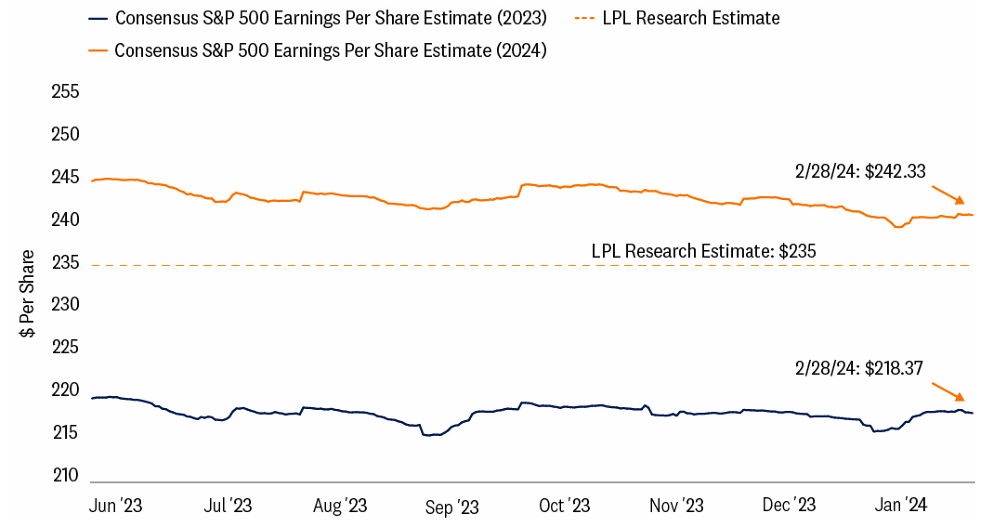

What To Do With 2024 Forecasts

The strong earnings season and resilience of estimates increase the chances that LPL Research’s forecast for S&P 500 EPS in 2024 at $235 is too low. Also consider we increased our forecast for U.S. economic growth this year, from 1% to 1.4% (based on gross domestic product). Moreover, artificial intelligence tailwinds remain firmly in place, last year’s healthcare and natural resources earnings declines are poised to reverse, cost pressures continue to ease, and companies have maintained a fair amount of pricing power.

On the flip side, the U.S. economy is poised to slow some this year. Our outlook for European economic growth is lackluster, and China’s economy faces significant headwinds and may not, in reality, even come close to the Bloomberg consensus GDP growth forecast of 4.6% for 2024. Add to that, we don’t have a lot of conviction in a weak U.S. dollar view, a wildcard for earnings, and it’s only early March. Bottom line, we’ll hold our estimate where it is for now while acknowledging both greater confidence that $235 can be achieved and an upward bias.

Estimates Have Held Up Very Well During Earnings Season

Source: LPL Research, FactSet 02/29/24

Indexes are unmanaged and cannot be invested in directly. Estimates may not materialize as predicted.

Conclusion

Fourth quarter earnings season delivered as we had hoped. Not only did corporate America deliver solid upside to estimates, overcoming some big bank charges, but guidance was strong enough to keep estimates from falling much at all. That raises the 2023 base and shores up confidence for 2024. The current LPL Research estimate is calling for about 7.5% earnings growth from the S&P 500 this year, slightly below the long-term average despite relatively easy comparisons following lackluster earnings growth of about 2% during a challenging 2023.

Strong results were needed to help justify rich valuations, and corporate America came through. If companies can deliver near-consensus earnings estimates in 2024, buoyed by big tech, and the Federal Reserve can engineer a soft landing as inflation continues to gradually ease, then we believe stocks stand a good chance of not only adding to year-to-date gains through year-end, but also keeping the price-to-earnings ratio (P/E) around 20, which we view as fair based on LPL Research’s macroeconomic outlook.

Asset Allocation Insights

LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral equities stance despite the strength of the latest stock market rally that has carried the S&P 500 over the 5,000 milestone. The improved outlook for economic growth and earnings, along with relative stability in interest rates, keeps the risk-reward trade-off for stocks and bonds fairly well balanced still, though upside over the rest of the year is likely to be modest.

Within equities, the STAAC continues to favor a tilt toward domestic over international equities, with a preference for Japan among developed markets, and an underweight position in emerging markets (EM). The Committee also recommends a slight tilt toward large caps and growth stocks. Finally, the STAAC continues to recommend a modest overweight to fixed income, funded from cash.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet.

Value investments can perform differently from the market as a whole. They can remain undervalued by the market for long periods of time.

The prices of small cap stocks are generally more volatile than large cap stocks.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

LPL Financial does not provide investment banking services and does not engage in initial public offerings or merger and acquisition activities.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value

RES-000823-0224 | For Public Use | Tracking #548504 (Exp. 03/2025)

For a list of descriptions of the indexes referenced in this publication, please visit our website at lplresearch.com/definitions.