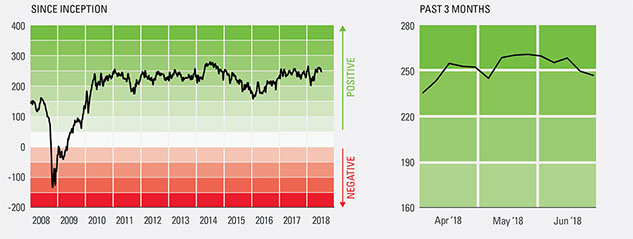

– The CCI is in the upper end of the range it has held since 2010.

– A decline in stock market volatility and improved retail sales were the main contributors to the CCI’s improvement, while wider credit spreads and a small decline in shipping traffic were slight offsets.

Click here to download a PDF of this report.

Source:

Source: LPL Research 07/25/18

Important Disclosures:

A CCI score of zero represents the baseline conditions in 2009, and subsequent CCI scores should be interpreted as a coincident measure of economic health in relation to this starting year.

A change in the sponsor of the retail sales component of the index starting in September 2015 required a recalibration of the data from the change forward. The change had a minimal impact on the level and direction of the index and resulted in a net change of under five points from its prior value in any month affected.

The VIX is a measure of the volatility implied in the prices of options contracts for the S&P 500. It is a market-based estimate of future volatility. When sentiment reaches one extreme or the other, the market typically reverses course. While this is not necessarily predictive it does measure the current degree of fear present in the stock market.

How the Index Is Constructed: To create the index we found 10 indicators that provided a weekly, real-time measure of the conditions in the economic and market environment. We then standardized these components compared with their pre-crisis 10-year average, equally weighted their standardized scores, and aligned the resulting index with zero at the start of 2009. Because our index is tailored to the current environment, the components of the CCI are periodically changed to retune the index to those factors most critical to the markets and economy, so it may continue to be a valuable investment decision-making tool. The current component measures include: BAA Spreads, Business Lending, Commodities, Fed Spread, Initial Jobless Claims, Money Market Fund Assets, Mortgage Applications, Retail Sales, Shipping Traffic, VIX Index. For a more detailed explanation of each measure please go to: https://lpl-research.com/CCIDefinitions.pdf.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

Tracking #1-723561 Exp. 07/19