Investor sentiment dramatically changed after Treasury Secretary Scott Bessent and other members of the Trump administration announced a temporary pause on tariffs with China. Was that sentiment shift warranted and did anything materially change? Estimates of the effective tariff rate continue to vary and have wide confidence intervals. Volatility will likely remain as the Trump administration is interested in managing perceptions with both midterms and markets in mind. This might explain the high degree of strategic variations in trade policy. Amid the variance, what hasn’t changed is the exceptional structure of the U.S. The two main reasons we believe U.S. exceptionalism will remain — probably for a very long time — are the depth and breadth of U.S. capital markets, and the reserve currency status of the U.S. dollar (USD).

What Just Happened?

In just a matter of hours last week, investors apparently decided that stocks were on sale, and it was time to buy. But nothing materially changed as consumers were still pessimistic about the future, firms were on the sidelines waiting to deploy capital amid tariff uncertainty, and the Federal Reserve (Fed) remained committed to their “Wait and See” stance.

The catalyst for the rally in the stock market was another announcement that the Trump Administration will place a pause on retaliatory tariffs, and this time, the corresponding trade partner was China.

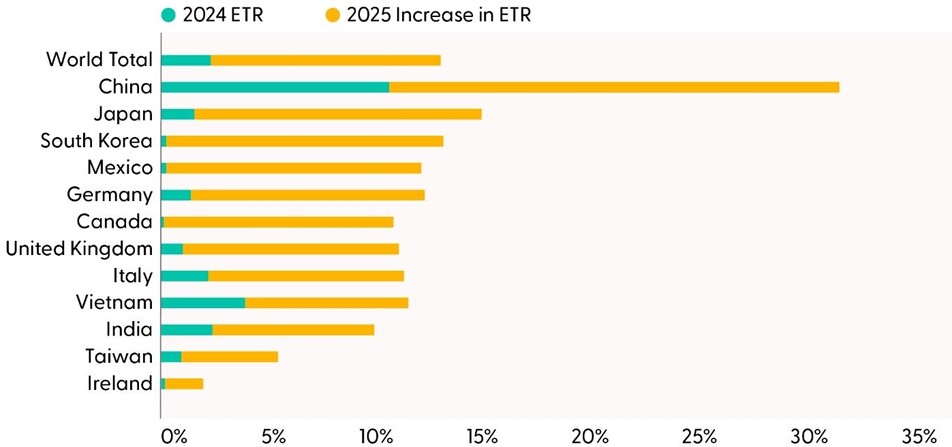

The temporary trade deal with China paused reciprocal tariffs for 90 days. Details are still emerging, but what that did was push the U.S. effective tariff rate (ETR) down to 13.1% from 22.8%, according to Fitch Ratings. Other estimates are higher.

However, this is far from being over. The temporary deal puts greater pressure on the two countries to develop a mutually amicable agreement. What investors know now is U.S. tariffs on Chinese products are down to 30% from 145%. And China will lower its tariffs on U.S. goods to 10% from 125%. The temporary agreement should allow for further discussions and negotiations. But even before these tariff spats, businesses have been aggressively shoring up their “China plus one” strategy, which describes the efforts of firms reducing reliance on just one country by expanding operations beyond China. Decreasing dependence on China does not mean decoupling all together. This is an important concept as trade negotiations continue.

Effective Tariff Rate Now Roughly 13%

Source: LPL Research, Fitch Ratings, Census Bureau 05/19/25

The Fed Is in An Awkward Position

Inflation is still above target and there is a lot of uncertainty about the trajectory of growth. The latest Federal Open Market Committee (FOMC) decision kept the benchmark interest rate unchanged at 4.25–4.5%. Here are the key takeaways. First, uncertainty has increased. The Fed acknowledged rising risks to both inflation and unemployment, signaling caution in future rate moves. They are being careful about their next moves because they do not want to be accused of being late, like they were during the post-COVID-19 recovery.

Second, inflation seems to be moving sideways. Fed Chair Jerome Powell described inflation as stable but above target, suggesting that the Fed is monitoring price trends closely. Our take is inflation will have some upward bounces in the coming months, but by the time we end the year, inflation should be trending lower, albeit above the 2% target. Nagging unknowns include where tariff rates will ultimately land and how they will impact growth and inflation.

Given the uncertainties, the Fed is in no hurry to adjust policy at this point.

Bigger Is Better

It seems headline risk has never been more rampant. Just last Friday, Moody’s, one of the “Big Three” global credit rating agencies, downgraded U.S. debt from Aaa to Aa1 because of profligate spending. This is not necessarily a big surprise given that S&P Global Ratings downgraded the U.S. back in August 2011, during the Obama administration. Fitch moved to a downgrade in 2023, so it was just a matter of time before Moody’s acted. Dangerously large fiscal deficits as a percent of GDP will likely put upward pressure on interest rates, but the U.S. could still maintain its exceptionalism. In fact, Moody’s appealed to the U.S. dollar’s dominant reserve currency status as a reason to upgrade the outlook to “stable” from “negative.”

Despite recent shifts, including trade policies, inflation concerns, and geopolitical tension, which have led some to predict U.S. exceptionalism will fade, we think the U.S. will maintain its unique role in global markets for a variety of reasons. One structural reason is that this country has deep capital markets.

Having the Biggest Markets Helps U.S. Exceptionalism

Source: LPL Research, International Monetary Fund (IMF) 05/19/25

The “Having the Biggest Markets Helps U.S. Exceptionalism” chart highlights some of the biggest stock exchanges in the world and how they rank as a percentage of global market capitalization. Of course, exchanges are the backbone of global financial markets, facilitating the buying and selling of securities. The New York Stock Exchange leads the world with a market capitalization of approximately $32 trillion as of today, followed closely by Nasdaq, which specializes in technology stocks and has a market cap of over $30 trillion. It’s quite a gap going down to the third largest, which is the Shanghai Stock Exchange with $7.1 trillion. To put this in perspective, the market cap of Microsoft and Apple together have a market cap larger than the biggest exchange outside this country. The breadth and depth of U.S. markets helps explain why American exceptionalism will persist, in our view.

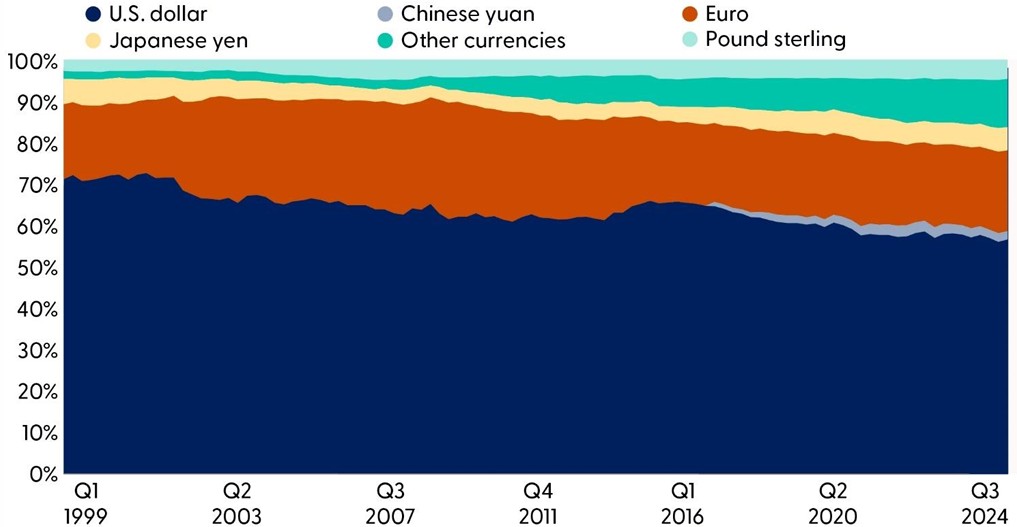

The Liquidity of USD Reserve Currency Status Provides Unique Structural Advantages

The U.S. dollar remains the world’s primary reserve currency, reinforcing demand for American assets. Since the Bretton Woods Agreement of 1944, the dollar has been the primary currency for global trade and financial transactions, with roughly 60% of global foreign exchange reserves currently held in USD. This dominance allows the U.S. to borrow at lower interest rates and maintain economic influence worldwide. However, recent trends indicate a gradual diversification among central banks, with increasing allocations to nontraditional reserve currencies, such as the Chinese yuan, Canadian dollar, and gold. With diversification comes risks, especially liquidity risks. The USD market is quite deep, giving global investors comfort that there will always be others willing to take the other side of a trade. While the dollar remains the most trusted currency, geopolitical shifts and economic fragmentation continue to challenge its supremacy.

U.S. Dollar Still Majority of Global Currency Reserves

Source: LPL Research, International Monetary Fund (IMF) 05/19/25

Conclusion

We are indeed experiencing many changes. For several months now, consumer spending has been growing faster than personal income. The divergence between these two metrics cannot last like this for long. The most likely scenario is a slowdown in spending to create balance with softer income growth. Furthermore, uncertainty around trade policy is creating a headache for firms eager to increase capital spending but unsure of when and how to implement strategic planning.

The soft survey data hints at a slowdown in hiring, but investors are still waiting for confirmation. Consumers feel jobs are less plentiful and purchasing managers allegedly say they have fewer plans to increase employment. But the weekly number of those claiming unemployment insurance benefits is historically low and layoff announcements have not quite filtered through yet.

As the Fed waits for the hard data to either confirm or deny the emerging narratives from the soft data, investors should not expect policymakers to be eager to cut rates. Amid the uncertainty, a few positives remain. The breadth and depth of U.S. markets provide an exceptional place to transact, and the liquidity of the USD market is unparalleled.

Following the recent stock market rebound, LPL’s Strategic and Tactical Asset Allocation Committee (STAAC) maintains its neutral stance on equities but does not rule out the possibility of a reversal lower and retracement of a good portion of the latest advance due to the ongoing uncertainty around tariffs and the increased likelihood of a slowdown.

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with a lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from FactSet or Bloomberg.

This research material has been prepared by LPL Financial LLC.

For public use.

Member FINRA/SIPC.

RES-0004065-0425 Tracking #741598 | #741600 (Exp. 05/26)

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value