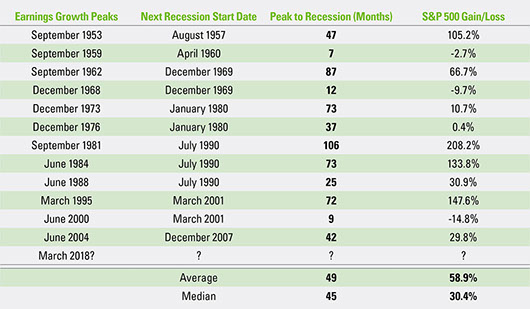

Earnings Growth Peaks Are Not Typically Soon Followed by Recessions

– Six decades of earnings growth peaks suggests that it took an average of about four years from a profit growth peak before the economy slipped into recession.

– The S&P 500 Index gained an average of 59% during periods between earnings growth peaks and the start of the next recession.

Click here to download a PDF of this report.

Source:

LPL Research, Thomson Reuters, FactSet, National Bureau of Economic Research 06/15/18

Important Disclosures:

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

All indexes are unmanaged and cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. All performance referenced is historical and is no guarantee of future results.

The opinions voiced in this material are for general information only and are not intended to provide or be construed as providing specific investment advice or recommendations for any individual security.

Tracking #1-748879 (Exp. 07/19)